A revenue-based financing agreement is an arrangement between two or more business entities, where one provides capital to support the other, and they share in the risk of the transaction.

Securing funding for any business can be a difficult process. Fortunately, there are a variety of financing options available. One promising option for many businesses is known as revenue based financing.

How Does Revenue Based Financing Work?

A revenue based financing agreement is a special type of business funding. A company provides the business with funds and is entitled to a portion of the business’s future revenue. The payments are a certain percentage of the business’s receivables, meaning the payment amounts may vary based on the business’s revenue. This percentage–also known as hold back percentage–is based on a multitude of factors such as: current debt servicing, industry, time in business, average bank ledgers, and monthly revenue.

Rather than accruing interest like a traditional loan, the total payoff is a fixed amount agreed upon at the time of investment. This is called a factor rate. The amount extended to the merchant is the purchase price and the amount collected from the funder is the purchase amount. Inevitably the purchase funder is purchasing a business’s receivables at a discount. Compare this amount to the total cost of other funding options. Often, RBF has a lower overall cost, but it is important to explore all options to make sure you are choosing the right solution for your business.

Characteristics of Revenue Based Financing

How Is Revenue Based Financing Different From Other Types of Funding?

There are several key differences between revenue based financing and other types of funding. The monthly payment amounts are determined by the business’s revenue. This means that if the business has a slow month, the payment amount may be modified. When business picks up, the payment amount may increase. If your business’s revenue fluctuates significantly, it may be harder to estimate how long it will take to fulfill the purchase amount.

With revenue based financing, the funder does not have an ownership interest in the business. There are no meetings of shareholders, and business decisions are made by the owners. RBF is generally acquired through a private entity rather than a bank.

RBF options generally offer a more streamlined application process and require less paperwork. As a result, the funds can be made available to you more quickly than with traditional loans.

How Long Has Revenue Based Funding Been Around?

This type of funding has been active in the United States for several decades, but did not start significantly increasing in popularity until after 2005. New revenue based investing firms are being founded every year, and this trend is expected to grow.

Who Uses Revenue Based Funding?

Business-to-business software-as-a-service companies utilize RBF more frequently than other industries. However, e-commerce, fashion, healthcare, and other industries utilize this funding type as well. When trying to secure RBF, being able to demonstrate strong revenue is generally more important than the particular type of business. Subscription-based businesses are usually strong candidates for RBF. Additionally, because of the eligibility requirements for RBF, it is often a good solution for new businesses with little or no credit history or collateral. Entrepreneurs who do not want to direct their personal assets toward the startup are also drawn to RBF.

Businesses that do not want or are not eligible for venture capital funding may find RBF to be a suitable alternative. Venture capital firms frequently require involvement in business decisions. Business owners who wish to retain complete control can do so with RBF.

Venture capital firms generally invest in large businesses where they can expect exceptionally high levels of return. Smaller businesses that are unlikely to generate those types of returns may have better luck securing revenue based funding from a firm with more achievable expectations. The demand for growth by a venture capital firm can put undue stress on a new business. Many startups have failed due to growing too fast. In many cases, slow and steady is the better option. Revenue based funding allows for more controlled growth.

Seasonal businesses also benefit from the revenue based financing model. Because the monthly payment is a set percentage of the monthly revenue, payments are lower when business is slow. This allows businesses to avoid overextending their business with high payments during lulls in revenue.

How To Secure Revenue Based Financing

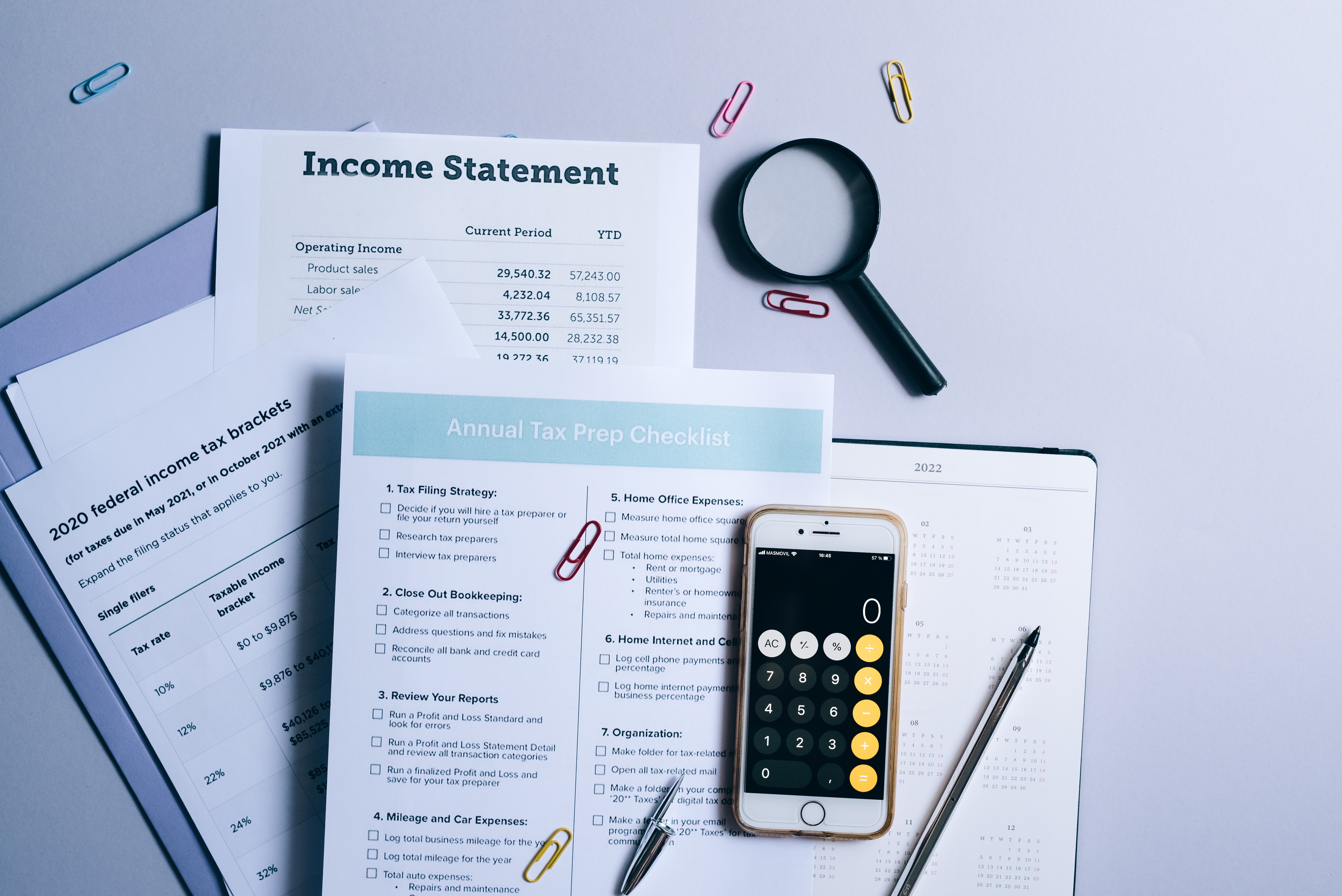

Necessary Documentation

As with all financing options, there is some paperwork associated with RBF. You will need three months of business statements and a strong business plan. You will need to show that you have been in business for at least six months and maintain an average monthly revenue of at least $12,500.

If you have lost your bank statements, you may be able to retrieve copies from your online banking account. In other cases, you can go to your local bank branch and ask for printouts.

When proving how long your business has been operating, you can use the incorporating documents. This document has a variety of names, including articles of organization and certificates of formation. You can also use tax documents.

Business Plan

A business plan is a written document that explains how the business works, what its goals are, and the plan for achieving those goals. The plan includes information about marketing strategies, daily operations, and financials. The business plan should be updated as the business grows, and the plan that is sent to a potential funder should be updated and detailed.

Choosing a Funder

Applying for financing is often overwhelming, especially for new businesses. It is important to choose a funder that you trust. Ask other businesses for recommendations and read online reviews. Call the company and ask for information about the different types of funding available. Before you agree to a funding option, read all legal documents carefully. Make sure you understand all the terms of the funding.

If you feel like revenue based financing might be the right option for you, contact us today. We are happy to answer any questions you may have and help you get started with the application process.

Sources:

- https://www.investopedia.com/terms/r/revenuebased-financing.asp

- https://techcrunch.com/2021/01/06/revenue-based-financing-the-next-step-for-private-equity-and-early-stage-investment/

- https://www.fundera.com/business-loans/guides/revenue-based-financing

- https://fitsmallbusiness.com/revenue-based-financing/

- https://theincorporators.com/blogs/news/how-to-prove-the-existence-of-your-company

- https://www.toptal.com/finance/venture-capital-consultants/revenue-based-financing

- https://howtostartanllc.com/business-loans/revenue-based-financing